Zimbabwe beats South African in securing zero-tariff access for blueberries to China

Guest article by Diego Castagnasso, a fresh produce and blueberry industry expert. Loud, opinionated, INFORMED! Diego writes DC’s B-Side’s newsletter as he speaks and speaks as he writes. You can subscribe, under your own peril, to his newsletter here or visit his less fun (for now) website Drip Consulting.

In the produce industry, there’s always a race to become the top exporter, the largest producer, or the first to enter a promising new market. I’ve witnessed a few of those in my region. Take Chile, for example—the country was the leading blueberry exporter for some time and was the first to open access to the Chinese market.

China remains the golden goose in the global agricultural industry—the market everyone wants to reach. For growers across all categories, gaining access to the Asian giant represents a major milestone. Entering this market is like earning a gold star on your chest, much like in middle school.

In this case, Zimbabwe has earned that star, beating South Africa to secure access to China. But even more notably, the African nation did it with zero tariffs, which is a significant accomplishment.

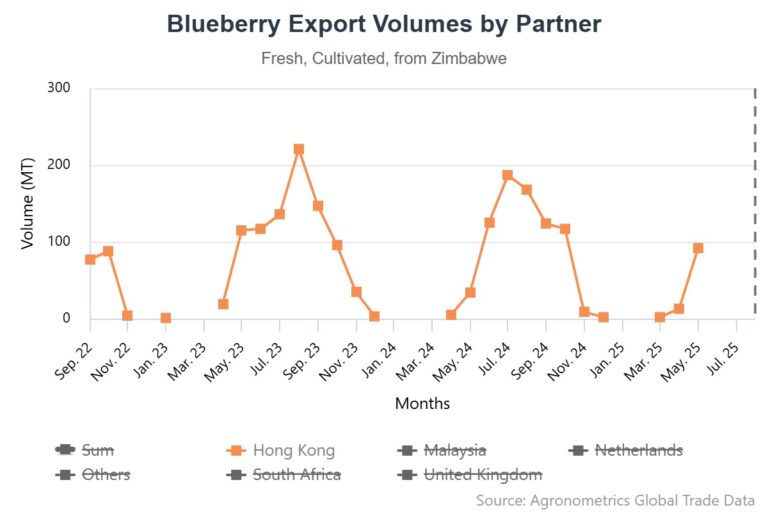

Now, it appears China is placing its bets on Zimbabwe. The reason is unknown, but I suspect the Chinese have been testing Zimbabwean blueberries through Hong Kong, which often acts as an informal ‘beta tester’ for products entering mainland China.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Despite the large difference in overall production volumes between Zimbabwe and South Africa, their exports to Hong Kong appear similar in size, and Zimbabwe may even be shipping more fruit. However, the two countries aren’t in direct competition, as their harvest peaks occur at different times. Zimbabwe’s peak arrives earlier, which allows the two to complement rather than compete with each other in the Chinese market.

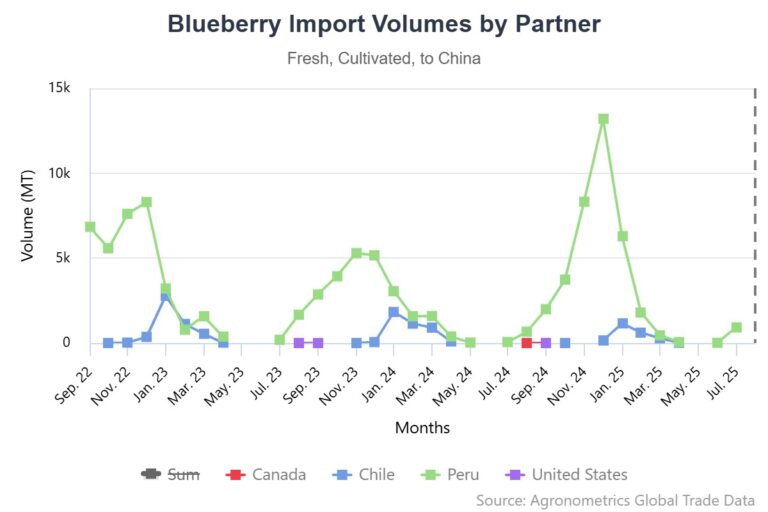

That said, both countries still represent relatively small volumes when compared to China’s leading blueberry suppliers: Peru and Chile. These two continue to dominate, thanks in part to their robust export infrastructure and tariff-free access.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Looking at the data, one question comes to mind: Why does China, with such a vast appetite for fruit, limit itself to just four blueberry suppliers? And why not lower tariffs to attract more competition?

I believe that if China extended zero-percent tariffs to countries like Argentina and Uruguay (which already have approved export protocols), they might start exporting more actively as well. It’s a matter of strategy, and such adjustments are often well within China’s capabilities when the timing is right.

In the meantime, congratulations to Zimbabwe. With this new market opportunity, the country becomes a more attractive destination for foreign investment in its blueberry sector.

P.S. In South America, Chile was the first to open the Chinese market for blueberries and eliminate tariffs through a Free Trade Agreement. Uruguay followed, but faced high tariffs (30 percent), which limited the impact of market access. Peru later joined with the added benefit of duty-free access, also thanks to its FTA.

P.S. 2. For clarity, when I said “the reason is unknown” regarding why China chose Zimbabwe, I meant that while there are many possible explanations, I don’t know which specific factors influenced the decision. The likely explanations, in my view, are political and unrelated to the blueberry market itself.

Source: Zimbabwe secures zero-tariff access for blueberries – FreshFruitPortal.com